35% OFF THIS MONTH: Only a few spots left. Enroll Now

Have A Question? Send us an email

enrollment@taxschool1040.com

Discover How To Make a Full Year of Income In As Little As 4 Months In The Tax Preparation Industry

...all without needing a degree, without accounting skills, or without any experience at all.

It's Easier Than You Think

Trust me, and in the process you will find you have more free time to do the things you really love.

If you've been wondering how you can make a living without having to spend hours and hours studying to obtain a degree, Discover our exclusive formula that enables you to learn the IRS tax code and complete an entire tax return in less than 60 minutes.

Are You Tired Of Not Getting

Paid Your Worth?

The truth about the tax preparation industry is that you don't need a degree, license or certification to become a highly paid tax professional. And you don't need to spend thousands of dollars on expensive books, classes, software and seminars to learn what the experts know.

With our proven strategies and insider knowledge, you'll not only gain the skills to thrive in the tax industry but also learn how to maximize your earning potential.

It's time to demand what you're truly worth and step into a future where your financial success is not held back.

What If I Told You There Was A Better And Easier Way?

Taxes are here to stay and we all know someone who could benefit from not only saving money on taxes, but levering them to create an additional stream of income! Brace yourself for what lies ahead with the amazing opportunity to

BE IN BUSINESS FOR YOURSELF, BUT NOT BY YOURSELF!

Become Financial Free

In A Growing Industry

Have More Time For

Loved Ones

Have A Fulfilling Career

You Love

Copy A Proven and

Successful Business Mode

Have Your Own Recession

Proof Business

Improve Your

Communication and

Sales Skills

Become Financial Free

In A Growing Industry

Have More Time For

Loved Ones

Have A Fulfilling Career

You Love

Copy A Proven and

Successful Business Mode

Have Your Own Recession

Proof Business

Improve Your

Communication and

Sales Skills

OUR MISSION

Empower employees who aspire to become successful entrepreneurs in the tax industry. We provide a proven blueprint that equips individuals with the knowledge, skills, and resources necessary to thrive in their own tax business.

WHAT IS THE GOAL THAT DRIVES OUR MISSION?

Our mission is driven by the belief that every employee have untapped potential and the ability to create their own path to success. We partner with our students to unlock this potential by offering a comprehensive training program that combines industry expertise, practical guidance, and ongoing support.

Introducing:

The Ultimate American Tax Academy Bundle!

Designed To Develop Employees Today To Become Entrepreneurs Tomorrow

Here's what's included:

The program contains a step-by-step, hands on experience to walk you through each stage of the

tax preparation business. It is designed to not only teach you everything you need to know but also provide real life, interactive learning opportunities along the way.

Proven Tax Business

Blueprint

You'll get instant access to launching and growing a successful tax business. It serves as a guiding framework, enabling our partners to make informed decisions, avoid common pitfalls, and maximize their chance of success.

One-on-One

Personalized Coaching

Beyond live group trainings, we are dedicated to providing ongoing support and mentorship to our partners.

We are committed to being there every step of the way helping our partners overcome obstacles and achieve their goals.

Unique Software To Make

Your Life Easier

Efficiency is key in the tax industry, and our interview mode tax software is built to boost your productivity. The software's user-friendly design and intuitive navigation empower you to prepare tax returns more quickly enabling you to take on more clients, Increase your earning potential, and establish a thriving tax preparation business.

Here's what's included:

The program contains a step-by-step, hands on experience to walk you through each stage of the

tax preparation business. It is designed to not only teach you everything you need to know but also provide real life, interactive learning opportunities along the way.

Proven Tax Business

Blueprint

You'll get instant access to launching and growing a successful tax business. It serves as a guiding framework, enabling our partners to make informed decisions, avoid common pitfalls, and maximize their chance of success

One-on-One

Personalized Coaching

Beyond live group trainings, we are dedicated to providing ongoing support and mentorship.

We are committed to being there every step of the way helping you overcome obstacles and achieve your goals.

Unique Software To Make

Your Life Easier

Efficiency is key in the tax industry, and our interview mode tax software is built to boost your productivity. The software's user-friendly design and intuitive navigation empower you to prepare tax returns more quickly enabling you to take on more clients, Increase your earning potential, and establish a thriving tax preparation business.

If You're Reading This, It Is

Because You Are An Aspiring

Entrepreneur Looking To Achieve More In Life!

I'm here to help you gain the confidence and expertise to handle any tax question you have for yourself or your client by providing Comprehensive Tools and Resources to Transform Your Aspiration into a Thriving Tax Business!

Here's What You'll Learn In The American Tax Academy!

Module One

Compiling Taxpayer Information

You will learn efficient techniques and strategies to compile and organize a taxpayer's information for seamless tax preparation. From gathering income sources and deductions to maintaining proper documentation, this module will equip you with the skills to streamline your tax preparation process. Get ready to master the art of compiling taxpayer information and enhance your tax filing experience.

Module Two

Filing status, dependents, & deductions

You will learn how to determine your clients filing status, understand the rules for claiming dependents, and maximize your deductions to reduce your tax liability. Get ready to gain the knowledge and skills needed to navigate these important aspects of the tax system effectively.

Module Three

Income

You will explore different types of income and their tax implications.

You'll learn about sources like wages, self-employment income, investments, and rentals. We'll cover taxable and non-taxable income, reporting requirements, and special considerations such as deductions and retirement contributions. You'll have a solid understanding of income types and how they affect your client taxes. Get ready to confidently report their income and optimize your tax position.

Module Four

Adjustments To Income

You'll learn about deductions and adjustments that can lower your client taxable income. We'll cover common adjustments like retirement contributions, student loan interest, self-employment expenses, and HSA contributions. You'll understand the eligibility criteria, limitations, and reporting requirements for each adjustment. We'll also explore other deductions, including educator expenses, alimony payments, and moving expenses. These deductions can further reduce your client taxable income and potentially lower their overall tax liability.

Module Five

Payments & Tax Credits

We'll cover how individuals can make tax payments and utilize tax credits to reduce their tax liability. You'll learn about payment options like estimated tax payments, withholding from wages, and payment plans. We'll also explore popular tax credits such as the child tax credit, earned income tax credit, and education credits. You'll have a solid understanding of making tax payments and leveraging tax credits to optimize your tax position. Let's get started on your journey to mastering "Payments and Tax Credits"!

FREE BONUSES!

Absolutely correct... Our primary focus is exceeding expectations by providing an abundance of value for you to not only understand the tax law, but also for you to accelerate your business and expand your clientele.

BONUS # 1

Tax Software - Simplifying Your Tax Preparation Journey!

As part of our tax academy course, you'll receive free access to professional tax software. This software features an interview mode that guides even the newest tax preparer through the process of completing tax returns with ease. With user-friendly navigation, comprehensive form coverage, error checking, time-saving efficiency, and up-to-date tax law compliance, our software empowers you to provide accurate and reliable tax services. Prepare to excel in tax preparation with our cutting-edge software as your trusted companion!

BONUS # 2

Mastering the Art of Successful Marketing in the Tax Industry!

This module is specifically designed to equip you with the essential skills and knowledge needed for you to master the art of successful marketing in the tax industry. You'll gain expert insights, learn cutting-edge strategies, and access practical tools to attract clients and establish a strong brand presence. Elevate your marketing game and take your tax business to new heights.

BONUS #3

Mindset Mastery & Goal Setting For Success

This module helps you set and achieve meaningful goals while transforming your perspective and mindset. Gain expert guidance, overcome obstacles, and unlock your full potential for business success. We understand that the journey of entrepreneurship is not without its challenges. That's why this module is dedicated to empowering you with the tools and techniques to set meaningful goals and achieve them, all while cultivating a resilient mindset. By shifting your perspective and embracing a growth mindset, you'll be equipped to overcome any obstacle that comes your way.

BONUS #4

Group Live Coaching Calls!

Feeling stuck with challenging client questions? Don't worry – our live coaching calls are here to help. Get direct access to an experienced instructor who will answer your toughest questions. With weekly group sessions during tax season, you'll never feel alone. You'll gain the confidence you need to excel in your tax practice. Don't let unanswered questions hold you back – conquer any challenge with our supportive coaching community!

14-Day Money Back Guarantee

You have nothing to lose. If you don't see the value in this revolutionary course and bundle in the next 14 days, I will refund you every penny. No questions asked.

And just so we're clear...

(Because we don't believe in wasting time)

You're in the right place if:

You've been successfully preparing tax returns for family and friends and now want to expand your services.

You're an employee looking to create an extra income.

You're looking to create more flexibility in your life.

You're a person looking to start your own business without huge cost barriers.

You're passionate about making a positive impact in your community by helping individuals navigate the complexities of the tax system.

You're serious about having a system in your business that helps you make money daily.

You're in the wrong place if:

You're searching for a get-rich-quick scheme

You're not interested in expanding your knowledge of the US Tax Laws to perform ethically in your business.

You don't like working with people.

You don't have a growth mindset and not looking for ways to grow personally.

You don't have ambition to become an entrepreneur.

You're not invested in the long-term success and sustainability of your self and your business.

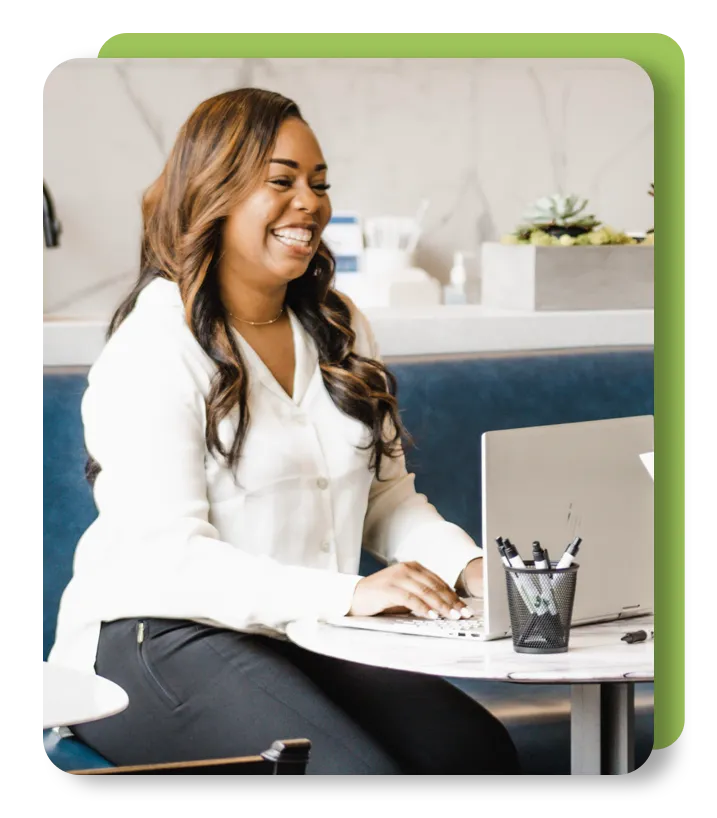

Meet Your Instructor

Jonquala Elom

The visionary behind this business. While working tirelessly in Corporate America, Jonquala realized the toll it took on her family. Juggling a demanding 9-to-5 job and occasionally pulling double shifts, she yearned for more time to dedicate to her loved ones. With three young children who required her attention, she felt that she couldn't give them the care they deserved.

Driven by this desire for a better work-life balance, Jonquala embarked on a journey to leave the corporate world behind and create her own business. Starting with offering tax services to family and friends on the side, she was determined to assist them with tax-related matters they struggled to comprehend. Recognizing the need for reliable tax professionals within her community, Jonquala saw an opportunity to make a difference and created American Tax Academy.

Jonquala possesses a valuable combination of an Enrolled Agent license, an Accounting Degree, and an impressive track record of over 12 years preparing tax returns. Her extensive knowledge and expertise in taxation make her a trusted authority in the industry. She not only comprehends the complexities of the tax system but also excels in simplifying the learning process, allowing newer preparers to grasp the complex tax law with ease. Jonquala's dedication to facilitating understanding and growth sets her apart as a reliable mentor in the realm of tax preparation.

Living by the motto "Each One, Teach One" Jonquala is dedicated to empowering her students to gain their freedom back and become successful entrepreneurs' in the tax industry. She equips her students with the very resources and tools she utilized to elevate her own business to a six-figure level, ensuring that they are afforded an opportunity to fulfil their entrepreneurial dreams, all while doing the things they love

12 Years in Business

1000+ Tax Clients

30+ Students

You've Got Q's? We've Got A's.

We understand you may still have some questions, so here are the most

common questions, we typically get asked about this program.

WHAT IS THE TAX PREPARER DEVELOPMENT PROGRAM?

A training program that teaches individuals the skills and knowledge needed to become proficient tax preparers. It covers tax laws, regulations, tax return preparation, and provide enhanced guidance on the use of tax software. Students will learn how to accurately complete tax forms, comply with tax laws, and communicate effectively with their clients. This program help individuals start and grow their business in the tax industry and enhance their existing tax knowledge.

WHEN DOES THE 2023 TAX PREPARER DEVELOPMENT PROGRAM START?

Registration will officially begin September 2023. We can't wait to share all the program details with you at that time. Keep an eye out for further announcements!

HOW LONG IS THE TAX PREPARER DEVELOPMENT PROGRAM?

Join our Tax Preparer Development Program for a transformative four-week experience. By completing our four-week program you'll be well prepared to launch a thriving tax business. Don't miss out on this amazing opportunity - Register Now!

WHO IS THE TAX PREPARER DEVELOPMENT PROGRAM FOR?

Our program is for anyone interested in starting or expanding their tax business and learning how to prepare tax returns. It's an opportunity to generate additional income. Whether you're a beginner or have some experience, our program caters to your needs. It's perfect for aspiring entrepreneurs, accountants/bookkeepers, career changers, finance professionals, and those seeking part-time work. Join us to gain the skills needed for success in the tax business.

WHAT IS THE FORMAT OF THE TAX PREPARER DEVELOPMENT PROGRAM?

The Tax Preparer Development Program offers a flexible format with self-paced modules and live online group coaching classes. You can learn at your own pace through the modules and receive real-time support during twice-weekly live coaching sessions. It's a comprehensive and adaptable learning experience designed to enhance your tax preparation skills.

WHAT IS INCLUDED IN THE TAX PREPARER DEVELOPMENT PROGRAM?

Self Paced Modules

Quizzes

Videos

Practice Tax Returns

Practice Tax Return Final Exam

Mindset Mastery & Goal Setting

Marketing and Sales

WHAT ARE THE DIFFERENT PAYMENT OPTIONS AVAILABLE?

We provide two exceptional payment choices. Our first option is the paid-in-full option priced at $197. Alternatively, we offer an installment agreement priced at $300, enabling you to begin with a down payment as low as $50 (explained below). The remaining balance will be required once you secure your first two clients. Our program operates on a results-driven approach, ensuring you experience the program's benefits before paying for it in full.

WHAT DOES THE $50 DEPOSIT COST COVER?

Our payment structure for the course is designed to offer flexibility and align with the success of our students. We understand that investing in education is an important decision, and we want to ensure that our students have the opportunity to fully benefit from our program before completing the payment.

Upon enrollment, a $50 deposit is required to secure your spot in the course. This deposit demonstrates your commitment to the program and allows us to reserve your place in the class. It also helps cover the initial costs associated with your enrollment, such as course materials and administrative expenses.

The remaining payment of $250 is deferred until you start receiving compensation from the services you learn in our program. We believe in the value and effectiveness of our training, and we want to provide you with the opportunity to put your newly acquired skills into practice and generate income before completing the payment. A payment of $125 will be deducted from your first two clients tax preparation fee. This approach creates a mutually beneficial arrangement where your success is directly tied to the completion of the remaining payment.

WHAT HAPPENS AFTER THE SUCCESSFUL COMPLETION OF THE TAX PREPARER DEVELOPMENT PROGRAM?

After successfully completing the Tax Preparer Development Program, you'll benefit from ongoing mentorship throughout the tax season to support you as you put your skills into practice. Additionally, you'll gain access to our tax software, empowering you with efficient tools for tax preparation. We also provide continued learning opportunities and a supportive community to help you thrive in the industry.

REFUND REQUEST POLICY

Our refund request policy is as follows: Once the class starts, no refunds will be issued. Due to the nature of our knowledge-based course, where knowledge cannot be reversed once learned, the course is considered non-refundable. This policy applies to all participants, and no exceptions will be made.

However, we do offer a 14-day money back guarantee. If you are not satisfied with the course within the first 14 days, you can request a refund during that period. Please note that this guarantee is applicable only within the specified timeframe.

We believe in the value and quality of our course and are confident that it will meet your expectations. We encourage you to make an informed decision before enrolling and take advantage of the 14-day money back guarantee if needed.

WHAT IF I MISS THIS PROGRAM WHEN WILL THE NEXT PROGRAM BE?

We prioritize the success of our students. We do not have pre-scheduled dates for the Tax Preparer Development Program. Instead, we launch a new academy when we can fully dedicate four weeks to our students' growth and achievement. Once the Tax Preparer Development Program reaches its capacity, registration will be closed, and you will not be able to enroll. Therefore, we encourage you to seize the opportunity and secure your spot in the current program to avoid missing out. Your success matters to us, and we are committed to providing you with the best learning experience possible.

WHAT IS THE TAX PREPARER DEVELOPMENT PROGRAM?

A training program that teaches individuals the skills and knowledge needed to become proficient tax preparers. It covers tax laws, regulations, tax return preparation, and provide enhanced guidance on the use of tax software. Students will learn how to accurately complete tax forms, comply with tax laws, and communicate effectively with their clients. This program help individuals start and grow their business in the tax industry and enhance their existing tax knowledge.

WHEN DOES THE 2023 TAX PREPARER DEVELOPMENT PROGRAM START?

Registration will officially begin September 2023. We can't wait to share all the program details with you at that time. Keep an eye out for further announcements!

HOW LONG IS THE TAX PREPARER DEVELOPMENT PROGRAM?

Join our Tax Preparer Development Program for a transformative four-week experience. By completing our four-week program you'll be well prepared to launch a thriving tax business. Don't miss out on this amazing opportunity - Register Now!

WHO IS THE TAX PREPARER DEVELOPMENT PROGRAM FOR?

Our program is for anyone interested in starting or expanding their tax business and learning how to prepare tax returns. It's an opportunity to generate additional income. Whether you're a beginner or have some experience, our program caters to your needs. It's perfect for aspiring entrepreneurs, accountants/bookkeepers, career changers, finance professionals, and those seeking part-time work. Join us to gain the skills needed for success in the tax business.

WHAT IS THE FORMAT OF THE TAX PREPARER DEVELOPMENT PROGRAM?

The Tax Preparer Development Program offers a flexible format with self-paced modules and live online group coaching classes. You can learn at your own pace through the modules and receive real-time support during twice-weekly live coaching sessions. It's a comprehensive and adaptable learning experience designed to enhance your tax preparation skills.

WHAT IS INCLUDED IN THE TAX PREPARER DEVELOPMENT PROGRAM?

Self Paced Modules

Quizzes

Videos

Practice Tax Returns

Practice Tax Return Final Exam

Mindset Mastery & Goal Setting

Marketing and Sales

WHAT ARE THE DIFFERENT PAYMENT OPTIONS AVAILABLE?

We provide two exceptional payment choices. Our first option is the paid-in-full option priced at $197. Alternatively, we offer an installment agreement priced at $300, enabling you to begin with a down payment as low as $50 (Explained below). The remaining balance will be required once you secure your first two clients. Our program operates on a results-driven approach, ensuring you experience the program's benefits before paying for it in full.

WHAT DOES THE $50 DEPOSIT COST COVER?

Our payment structure for the course is designed to offer flexibility and align with the success of our students. We understand that investing in education is an important decision, and we want to ensure that our students have the opportunity to fully benefit from our program before completing the payment.

Upon enrollment, a $50 deposit is required to secure your spot in the course. This deposit demonstrates your commitment to the program and allows us to reserve your place in the class. It also helps cover the initial costs associated with your enrollment, such as course materials and administrative expenses.

The remaining payment of $250 is deferred until you start receiving compensation from the services you learn in our program. We believe in the value and effectiveness of our training, and we want to provide you with the opportunity to put your newly acquired skills into practice and generate income before completing the payment. A payment of $125 will be deducted from your first two clients tax preparation fee. This approach creates a mutually beneficial arrangement where your success is directly tied to the completion of the remaining payment.

WHAT HAPPENS AFTER THE SUCCESSFUL COMPLETION OF THE TAX PREPARER DEVELOPMENT PROGRAM?

After successfully completing the Tax Preparer Development Program, you'll benefit from ongoing mentorship throughout the tax season to support you as you put your skills into practice. Additionally, you'll gain access to our tax software, empowering you with efficient tools for tax preparation. We also provide continued learning opportunities and a supportive community to help you thrive in the industry.

REFUND REQUEST POLICY

Our refund request policy is as follows: Once the class starts, no refunds will be issued. Due to the nature of our knowledge-based course, where knowledge cannot be reversed once learned, the course is considered non-refundable. This policy applies to all participants, and no exceptions will be made.

However, we do offer a 14-day money back guarantee. If you are not satisfied with the course within the first 14 days, you can request a refund during that period. Please note that this guarantee is applicable only within the specified timeframe.

We believe in the value and quality of our course and are confident that it will meet your expectations. We encourage you to make an informed decision before enrolling and take advantage of the 14-day money back guarantee if needed.

WHAT IF I MISS THIS PROGRAM WHEN WILL THE NEXT PROGRAM BE?

We prioritize the success of our students. We do not have pre-scheduled dates for the Tax Preparer Development Program. Instead, we launch a new academy when we can fully dedicate four weeks to our students' growth and achievement. Once the Tax Preparer Development Program reaches its capacity, registration will be closed, and you will not be able to enroll. Therefore, we encourage you to seize the opportunity and secure your spot in the current program to avoid missing out. Your success matters to us, and we are committed to providing you with the best learning experience possible.

Joining "This Amazing Program" Is Easy!

Tax Preparer Development Program

$300

$197

A low cost, one-time payment. Owe nothing when you're done.

Get Instant Access!

Tax Law Training

Live Virtual Group Zoom Classes

Practice Tax Returns

PTIN Assistance

Professional Tax Software

Software Training

Technical Support

Unlimited Tax Returns

Access to Private Facebook Group

Ultimate Guide to Marketing

File Personal Tax Return FREE*

50/50 Profit Split

Tax Law Training

Live Virtual Group Zoom Classes

Practice Tax Returns

PTIN Assistance

Professional Tax Software

Software Training

Technical Support

Unlimited Tax Returns

Access to Private Facebook Group

Ultimate Guide to Marketing

File Personal Tax Return FREE*

50/50 Profit Split

If you've still got questions for us or want to chat, please email us anytime! We'd love the